Did you know that while 93% of customers (Source: kpmg.com) say they’d prefer to see all their bills in one centralized location, only 46% actually use their bank’s digital payment tools? The gap between preference and action reveals a deeper issue: complexity. For industries like iGaming and fintech, the stakes are even higher. With cross-border transactions, changing regulations, and increasing fraud risks, managing payments can feel like a never-ending uphill battle.

But what if there was a better way? Enter Corytech’s Zero-Stress Payments, a solution designed to simplify operations and give businesses the freedom to focus on growth. By prioritizing technical partnerships, tackling fragmentation, and ensuring robust fraud protection in payments, Corytech aims to turn a major operational headache into a competitive advantage.

In this interview, we sit down with Corytech’s CEO, Dmytro Miliukov, to explore how their Zero-Stress philosophy is redefining the iGaming payment solutions landscape and why simplifying payment systems is no longer optional—it’s essential for sustainable success.

Business in the Age of Stress

Stress levels in business leadership seem to be climbing higher than ever. Why do you think payments, in particular, are contributing so much to this strain? Are industries like iGaming and fintech facing unique challenges in this regard?

Dmytro: “You’re absolutely right. A recent study showed that over 70% of business leaders (by the LinkedIn research) feel overwhelmed by the pace of change and operational complexities. In industries like iGaming and fintech, the challenges come at you from all sides—managing multi-jurisdictional payments, dealing with fraud threats, ensuring smooth customer experiences, and, of course, juggling scalable payment infrastructure.

“Stress doesn’t just affect leaders personally; it seeps into businesses, creating inefficiencies and bottlenecks. That’s why we believe simplifying processes isn’t just helpful—it’s essential for sustainable growth. And when it comes to payments, Corytech’s Zero-Stress philosophy is all about taking that stress off your plate so you can focus on what truly matters: your business.”

Understanding Stress in Business: A Hidden Productivity Killer

Photo credit: Corytech.com

Let’s get specific—what’s really keeping leaders in the iGaming sector awake at night? Is it the technical complexities, or does it go deeper into operational risks like fraud or compliance?

Dmytro: “Managing payments across multiple jurisdictions is a major source of stress. Each region has unique regulations, tax penalties, and currencies, creating layers of complexity. Add to that the constant need for fraud protection in payments and the pressure to deliver flawless player experiences, and it’s easy to see why businesses feel overwhelmed.

“Stress like this doesn’t just cause headaches—it impacts productivity and decision-making. Leaders often end up firefighting instead of planning strategically, and that limits growth.”

For businesses that feel buried under layers of regulations and fragmented payment systems, where do they even start to address these challenges?

Dmytro: “With Zero-Stress Payments, our goal is simple: we handle the complexity so you don’t have to. Through advanced payment orchestration, we consolidate fragmented systems into one simple platform, ensuring everything runs smoothly in the background. You get peace of mind knowing that cross-border payment management, compliance, and scalability are taken care of.”

The Zero-Stress Philosophy: A Business-Centric Approach

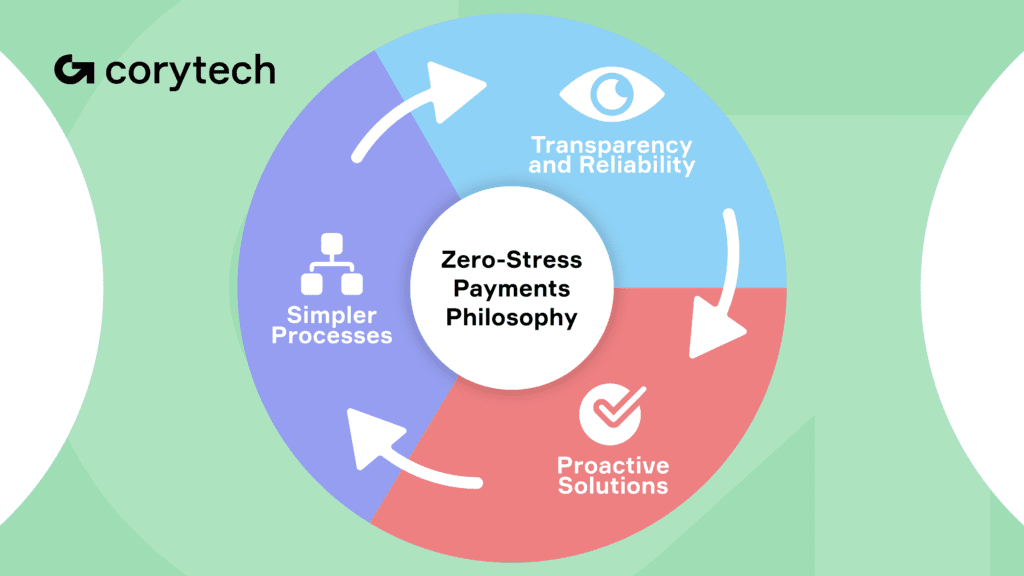

Corytech advocates for a Zero-Stress philosophy. That sounds amazing, but can you walk us through what “Zero-Stress” really means in practice?

Dmytro: “Absolutely. Zero-Stress Payments is about more than just technology—it’s a mindset. The idea is to give businesses the freedom to focus on their primary operations while we handle the payments. We emphasize three key principles:

- Simpler Processes: Consolidating payment systems onto one platform for simplified payment systems.

- Transparency and Reliability: Secure, visible transactions that build trust.

- Proactive Solutions: Addressing challenges like compliance and scalability before they become problems.

“It’s not just about solving issues—it’s about creating a partnership where businesses feel supported at every step.”

You talk about payments, but could this approach extend to solving other operational pain points? Can a mindset of simplicity ripple across a business?

Dmytro: “It does. Even our event booths are designed as stress-free zones—a place where merchants can relax, have a cup of tea, and discuss their growth plans with us. This philosophy of calm, care, and efficiency is woven into everything we do.”

Identifying Zones of Stress in Payments

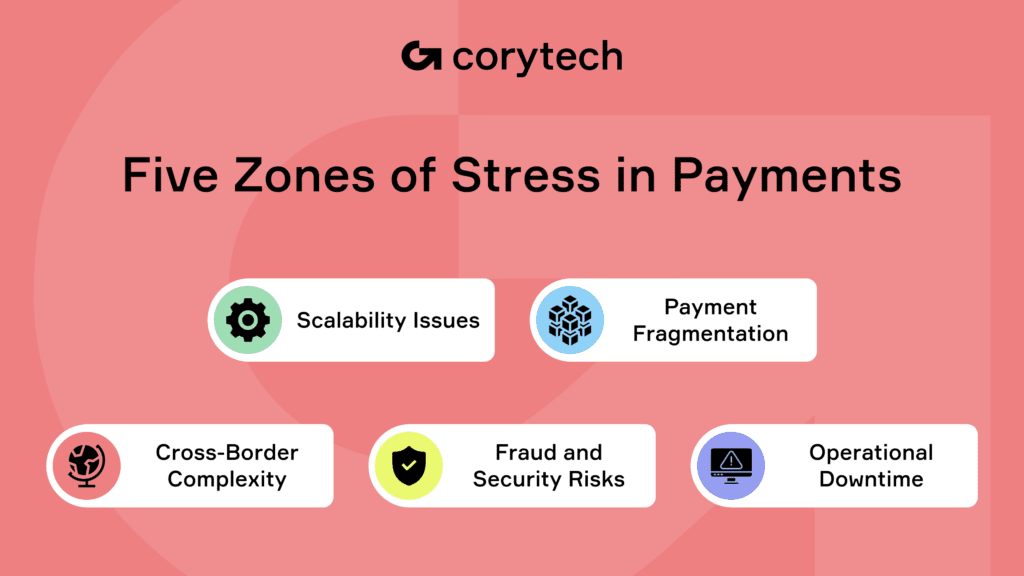

If you had to break it down, where do businesses feel the most stress in their payment systems? Are some of these challenges amplified in high-stakes industries like iGaming?

Dmytro: “We’ve identified five major zones of stress:

- Payment Fragmentation: Managing multiple providers and methods can be chaotic.

- Cross-Border Complexity: Regulatory requirements and currency exchanges add significant pressure, highlighting the need for efficient payment solutions.

- Scalability Issues: As businesses grow, their scalable payment infrastructure often lags behind.

- Fraud and Security Risks: High-risk industries like iGaming are constantly under threat.

- Operational Downtime: Interruptions in payment systems can lead to lost revenue and trust.

“By addressing these zones systematically, we help businesses regain control and reduce stress.”

How Corytech Reduces Payment Stress

Let’s talk about solutions. How does Corytech’s Zero-Stress Payments turn a tangled web of payment complexities into a seamless process?

Dmytro: “The challenges outlined in the research reflect the very issues Corytech’s platform is designed to solve. Consider this: the use of online payments through billing websites increased by 15% between 2010 and 2023 (Source: https://datos-insights.com/reports/how-americans-pay-their-bills-sizing-bill-pay-channels-and-methods-2023-edition/), while bank bills payments in adoption dropped by 17%. Why? Customers find individual billing websites marginally more convenient, despite their limitations. Similarly, businesses often default to fragmented systems that prioritize short-term fixes over long-term efficiency.

“Corytech takes a different approach by offering:

- Simplified Orchestration: Much like the centralized dashboards that customers prefer, Corytech unifies all payment processes on a single platform.

- Global Reach with Local Expertise: Our tools are designed for cross-border payment management, ensuring compliance with regional regulations.

- Growth-Ready Infrastructure: With a scalable payment infrastructure, businesses are prepared to grow without limitations.

- Advanced Security: Real-time fraud detection delivers unmatched fraud protection in payments.

- 24/7 Support: Because, as the research points out, even the best systems need human-centric solutions to address emergencies and complex queries.”

The Business Benefits of Zero-Stress Payments

You’ve explained the “how,” but what’s the “why”? What’s the tangible payoff for businesses that adopt Corytech’s Zero-Stress Payments?

Dmytro: “The benefits are both immediate and long-term. Here are a few:

- Enhanced Productivity: Freeing up resources to focus on growth instead of firefighting.

- Cost Efficiency: Saving on the overhead costs of managing fragmented systems.

- Customer Trust: Smooth and secure transactions improve player confidence, a key to success in iGaming payment solutions.

- Future-Proof Growth: A flexible infrastructure supports scalability, ensuring sustainable success as part of fintech growth strategies.

“When payments are stress-free, businesses have more energy and resources to innovate and succeed.”

A Stress-Free Philosophy for a Complex World

We’ve talked about payments, but could the Zero-Stress philosophy serve as a broader model for simplifying other aspects of business?

Dmytro: “Stress-free operations aren’t just about payments—they’re about creating a culture of simplicity and focus. When you eliminate unnecessary complexity, you unlock opportunities for better collaboration, clearer strategies, and sustainable growth.”

The pace of change is relentless, especially in fintech. How does partnering with Corytech give businesses an edge in navigating this complexity?

Dmytro: “In a world filled with high pressure and constant change, having a dependable partner makes all the difference. Corytech isn’t just a service provider; we’re your trusted ally. From ensuring compliance to providing 24/7 support, we take on the stress so you can thrive.”

Closing Thoughts: Stress-Free Everything

What’s your one piece of advice for businesses that are ready to tackle their payment stress but don’t know where to begin?

Dmytro: “The message is simple: Complexity doesn’t have to be stressful. At Corytech, we believe that simplifying payments isn’t just a fix—it’s the foundation for operational transformation and long-term growth. Our Zero-Stress philosophy is more than just a slogan; it’s a commitment to helping businesses thrive by turning challenges into opportunities.”

And finally, what’s next for Corytech? How do you see the Zero-Stress philosophy shaping the future of payments and business operations?

Dmytro: “Our vision is clear: to empower businesses to build legendary success stories through ease, simplicity, and innovation. As payment systems grow increasingly complex, we’re here to ensure they remain manageable and stress-free. We invite every business to explore Corytech’s solutions and experience how our Zero-Stress philosophy can transform the way they operate and grow.”