The UK iGaming market is a powerhouse, firmly established as the second largest globally. As of 2024, its valuation reached an impressive £14.7 billion, up from £9.7 billion in 2023—a testament to its robust growth. But what lies ahead in 2025 and beyond? Industry forecasts predict sustained expansion, driven by technological innovations, regulatory updates, and a cultural affinity for gaming that shows no signs of waning.

Projections for 2025 and beyond suggest continued expansion, with the remote gambling sector expected to surpass £7 billion in GGY by 2026. With innovations like live dealer games, virtual reality, and the use of advanced payment technologies, the market is on track to exceed £1.5 billion per quarter. However, operators face increasing competition and regulatory scrutiny, making adaptability to changing technologies and frameworks essential.

Corytech’s payment orchestration platform positions operators to thrive in this dynamic environment by enabling quick adoption of diverse payment methods, guaranteeing compliance, and enhancing the player experience. In a market where innovation drives success, businesses that fail to adapt risk being left behind.

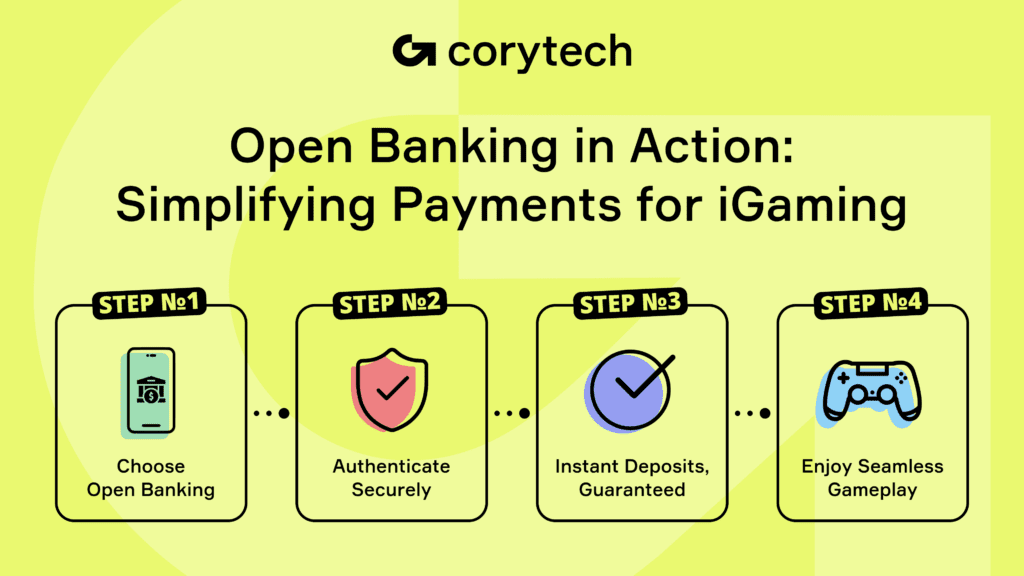

Rise of Open Banking in the UK: A Game-Changer for Payments

Open Banking has redefined the payments scenario, and in 2025, it’s set to revolutionize how transactions are conducted across the UK. With more than 11 million active users and 11.5 million payments processed monthly, open banking has grown beyond its initial purpose of enhancing competition. It is now a cornerstone of the UK’s drive to create a digital and innovative data economy powered by legislative advancements and industry collaboration.

The Data (Use and Access) Bill, introduced in 2024, provides the foundation for next-generation open banking. It supports secure and efficient data sharing, fostering innovation and enabling businesses to offer more personalized services. For iGaming operators, this evolution means faster deposits and withdrawals and more robust tools for fraud prevention and player verification.

The Government’s National Payments Vision (NPV) has increased the importance of open banking in creating ubiquitous account-to-account payments, improving efficiency and security for businesses and consumers alike. The addition of commercial variable recurring payments (cVRPs) in 2025 opens the door for subscription services, utility bill management, and other use cases, giving players greater control over recurring transactions.

Open Banking’s Benefits for iGaming Operators

For iGaming, the effects of open banking in 2025 are profound:

- Speed and Efficiency: With the expansion of variable recurring payments, operators can offer instant, secure deposits and withdrawals, eliminating delays that frustrate players.

- Trust and Transparency: Enhanced data-sharing frameworks boost player confidence, reduce fraud risks, and confirm compliance with stringent UK regulations.

- Personalization: Collaboration with open finance expands the scope of specific financial products, from personalized budgets to affordable credit options for players, improving their gaming experience.

Imagine a scenario where a player not only deposits funds instantly but also sees real-time updates on spending patterns, budgeting advice, or gaming limits—all thanks to open banking-enabled systems. It’s not just about payments; it’s about building trust and loyalty.

Corytech’s Role in Integrating Open Banking

Corytech’s payment orchestration platform smoothly implements the latest open banking capabilities. By leveraging features like commercial VRPs and automated compliance tools, operators can deliver faster, more secure payment options while reducing operational complexity.

Looking to the future, Corytech is also preparing to integrate open banking with digital wallets—a key growth area identified by the NPV. This combo will enable even more instant account-to-account payments, enhancing the player experience.

As open banking continues to grow, iGaming operators that embrace its potential will stay competitive and redefine the standards for convenience, security, and trust in the industry.

Safer Gambling: A Shared Responsibility

The UK Gambling Commission has set the bar high when it comes to responsible gambling. Regulations like affordability checks, deposit limits, and cooling-off periods are designed to protect players from financial harm. While essential, these measures pose challenges for operators who must balance compliance with an enjoyable user experience.

This is where innovative solutions from providers like Corytech shine. Their automated compliance tools simplify adherence to these regulations, enabling operators to focus on creating engaging platforms while safeguarding their reputation. When players feel protected, trust grows—and so does loyalty.

The Mobile Payments Boom: Convenience at Players’ Fingertips

Mobile payments have become the preferred transaction method for UK iGaming players. The market was valued at approximately £1.26 billion in 2023 and is projected to reach around £5.56 billion by 2030, growing at a CAGR of 22.3%. Systems like Apple Pay and Google Pay, powered by NFC, QR codes, and biometric authentication, offer unparalleled convenience and security, allowing players to make instant deposits and withdrawals directly from their smartphones.

For iGaming operators, integrating mobile payment solutions is no longer optional. Players demand fast and secure transactions that fit their mobile-first lifestyles, and Corytech simplifies this process with effortless implementation. Beyond gaming, mobile payment apps support automated recurring payments, enhancing user convenience and financial management.

As fintech and digital banking innovations drive rapid adoption, mobile payments are reshaping the iGaming industry. Operators embracing these technologies will meet rising player expectations and position themselves as leaders in the current digital economy.

Opportunities with Payment Orchestration Platforms

Managing multiple payment methods while staying compliant in a market as complex as the UK can feel overwhelming. That’s where payment orchestration platforms come into play. Corytech’s solution centralizes payment management, offering flexibility, efficiency, and peace of mind.

From Open Banking to mobile wallets and traditional card payments, Corytech promises that every transaction is smooth and secure. This allows operators to focus on delivering exceptional gaming experiences while leaving the complexities of payment processing to the experts.

Preparing for the Future

The UK’s iGaming market continues to set trends, from the rise of Open Banking to the growing demand for mobile wallets and robust player protections. Success in this dynamic environment requires more than just following trends—it demands proactive innovation.

With Corytech’s zero-stress payment solutions, operators can confidently navigate these challenges, catering to changing player preferences while maximizing compliance. After all, iGaming is about creating memorable experiences; stress-free payments are a big part of that equation.