Thailand’s Prime Minister Paetongtarn Shinawatra is facing a parliamentary motion of No Confidence tomorrow (March 26), which may scupper her US$9 billion (£7.1bn) personal project to make her nation a leading regional casino-resort hub.

But a bigger and more salient threat overshadowing her gaming development plan is that weak fiscal oversight and betting regulations may turn Thailand–the seventh most popular tourist destination in the world–into a major gambling money laundering centre.

So warns leading money markets and fintech expert Lissele Pratt, Co-Founder and Chief Growth Officer of Capitalixe, a multi-million dollar fintech advisory, who has deep knowledge of gambling and cryptocurrency.

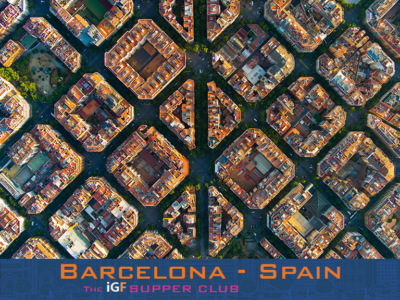

Despite growing opposition, public protests, and the looming vote of no confidence for the pro-gambling PM, Thailand’s Casino Entertainment Complex Bill continues to advance, with the special committee overseeing the project confirming Bangkok, Chon Buri, Chiang Mai and Phuket as the first four complex locations.

World’s Next Gaming Hub

But as Thailand positions itself to become the world’s next gambling hub–with a casino bill passing through parliament that could shake up the nation’s economy and establish it as the world’s third-largest gambling market, potentially overtaking Singapore and ranking behind Macau and Las Vegas–experts foresee problems ahead.

The country’s Casino Entertainment Complex Bill aims to legalise gambling within integrated entertainment resorts and marks a major shift from Thailand’s longstanding gambling prohibition.

According to the highly-respected English language Bangkok Post newspaper, around 60 percent of adult Thais engage in some form of nefarious betting. But the move to legalise casinos, paradoxically, remains deeply unpopular.

Polls show that 59 percent of the country’s 78 million citizens oppose the initiative. And experts are also sounding the alarm over gaps in the draft bill’s consumer protections and financial regulations.

Financial Crime

But with estimates predicting that the Thai gambling industry could generate up to US$9.1 billion (£7.1 bn) in gross gaming revenue annually, it’s also being touted as a golden financial opportunity — and one that’s already got the attention of gambling heavyweights, among them MGM Resorts, Genting Singapore and Las Vegas Sands.

“Thailand is saying: ‘We’re open for business.’ But the rulebook is still being written. Licensing requirements, tax structures, and operational restrictions are not firmly in place.

“If Thailand wants a successful and sustainable gambling market that attracts investment, the key is strong financial oversight because once the doors open, so does the risk of economic crime,” she warns.

Thailand already has AML laws and is actively updating them. Their Anti-Money Laundering Act has existed since 1999, but according to Pratt: “Gambling brings a whole new level of complexity, one that Thailand isn’t ready for.

“If Thailand doesn’t get this right from day one, they could end up like Cambodia, where weak regulations turned the casino sector into a money laundering hub.

“Cambodia was grey-listed by the Financial Action Task Force (FATF), and foreign investors backed out.

Warning Shot

“It took four years of intense reforms to fix the damage.

“Thailand cannot afford to make the same mistake. This means stringent financial regulations and oversight for operators from the start. And right now, the [proposed] bill doesn’t ensure this.”

Meantime, the vote of No Confidence against Paetongtarn Shinawatra–the daughter of billionaire populist and former prime minister Thaksin Shinawatra, who also tried to legalise gambling during his 2001–2006 tenure–-is not expected to pass.

Shinawatra’s Pheu Thai-led coalition holds a comfortable 322-seat majority in the 500-seat House of Representatives.

But it remains a warning shot over the bows of her government and a reminder that the proposed gambling bill still has a ways to travel.