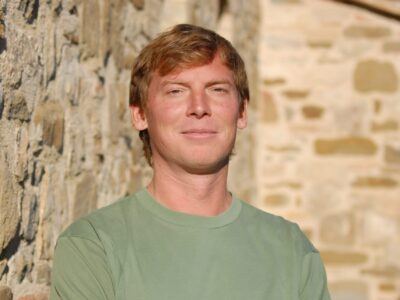

American gambling is full of contradictions, but one industry veteran has crushed market dynamics and knows where things are heading: Meet U.S. gaming guru and Managing Partner for KPMG, Las Vegas, Rick Arpin.

A Vegas native with more than 25-years of industry experience–15 of them spent at MGM Resorts–Rick met iGamingFuture at ICE Barcą for an exclusive tête-à-tête to discuss the key challenges facing the U.S. market.

These are his headline takeaways:

On Prediction Markets

Prediction markets have exploded onto the U.S. gaming scene. Operating under federal oversight, they controversially offer sports betting in all 50 states, triggering more than a dozen legal challenges from state regulators and tribal factions.

Their rapid rise has divided stakeholders across the industry, but Rick believes the current situation cannot last.

“Something has to give, one way or another,” he told iGF. “That could come through successful legal challenges, regulatory intervention, pressure from licensed operators or public opinion pushing back.

“What’s interesting is how quickly this has become a front-and-centre issue. The pace of change is relentless.”

Taxes

As U.S. sports betting matures, states are increasingly moving away from infancy towards more robust regulations and higher taxes.

Illinois has become one of the most high-profile examples, enacting both a sliding tax scale that taps out at an eye-watering 40 percent of GGR, and a per-bet surcharge.

Discussing the sustainability of higher tax rates, Rick shared that “some jurisdictions are going too far and leaving operators with no room to move. If operators need to leave a certain market to prove this point, that’s exactly what they should do.”

But the real issue, he believes, centres on education: “Gambling is often viewed as a ‘sin industry,’ making it politically easy to raise taxes and many politicians don’t understand the commercial realities or the effect of increases.

“The only way we can solve this is through more education and targeted lobbying.”

A more sustainable tax rate, in Rick’s view, sits around the 15-20 percent range, which “allows governments to generate meaningful revenue while still giving operators room to invest, compete, and channel players away from unregulated alternatives.

“Once you move toward 40 percent, you’re in dangerous territory. As we’ve seen in other jurisdictions, it doesn’t serve the market, players or the taxable base.”

Trump Slump

In the last 12-months, Las Vegas has experienced declining visitor numbers and volatile revenue figures, but Rick sees this as a temporary, not long-term decline.

“Vegas has faced a perfect storm of short-term pressures: Years of cumulative price increases, tariffs, higher labour costs and lingering post-COVID workforce challenges,” he explained.

“This is cyclical, not structural.

“Las Vegas has an incredible track record of reinvention. It’s one of the most resilient tourism destinations in the world, with unmatched infrastructure, entertainment and brand power; it will adapt, recalibrate and come back stronger.”

iCasino Momentum

Despite Maine starting the year by becoming the eighth state to legalise online casinos, Rick doesn’t expect a fresh wave of expansion this year.

“I don’t think we’re on the verge of widespread legalisation,” he said. “If there’s short-term momentum, it may come indirectly through pressure created by prediction markets rather than traditional expansion.”

The resistance, he argues, is cultural as much as political: “There’s still a big difference between sports betting–which is deeply ingrained in U.S. culture–and the idea of having a slot machine in your pocket.”

Cannibalisation

Fears of land-based casino cannibalisation remain one of the most cited reasons for opposition to online casino expansion. While Rick acknowledges that this is a “complex topic, with credible data on both sides of the argument”, he believes resistance misses the bigger picture.

“Customers are clearly telling operators how they want to engage,” he said. “Ignoring that doesn’t protect your business.”

“Land-based operators are best positioned to succeed in an omnichannel world. They already have brand recognition, customer databases and physical destinations. When done right, online and land-based can complement each other rather than compete.

“Instead of protesting digital expansion, land-based operators should be leading it. This is a huge opportunity to meet customers where they are, offer safe and regulated experiences and strengthen long-term loyalty across channels.”

So What’s Next?

“With the breakneck pace of innovation and change in the U.S. market, the single biggest piece of advice we’ve been giving clients recently is to cut through the noise and focus inwards,” Rick told me.

“Everything is competing–AI, prediction markets, sweepstakes, crypto, new verticals–and almost all of it can become a distraction.

“Operators need to get their house in order first–understanding their customer base, cost structure, technology and regulatory exposure–then they can forecast.

“Flexibility is important, but not everything deserves your time or capital.”