Illinois’ new per-wager tax is, remarkably, reshaping sports betting in the great American prairie state, with players placing fewer bets but risking larger stakes.

And contrary to warnings by naysayers, early data suggests the levy is effectively boosting state coffers, while prompting unexpected and unique shifts in consumer behaviour.

Whether it’s in the U.S. or Europe, tax rises are on the horizon in multiple gambling jurisdictions, much to the dismay of operators and industry stakeholders.

Operators assert that steep increases threaten the future viability of markets by reducing competitiveness and incentivising offshore gambling. But early data from Illinois reveals a curious and unexpected pattern of sports betting spending following the state’s recent per-wager tax levy.

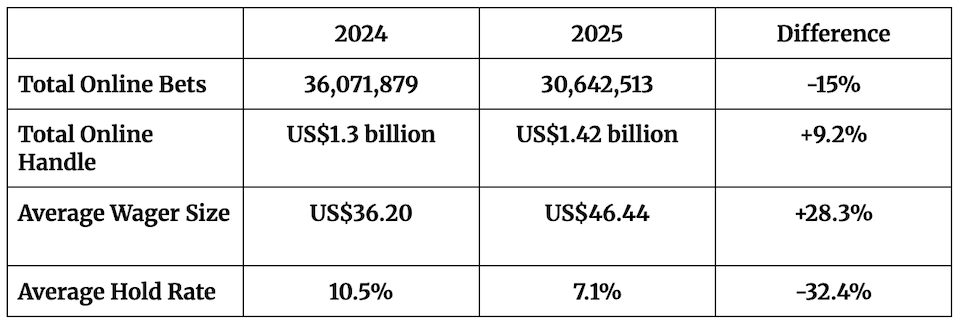

While total online sportsbook revenue for September fell by 15 percent to just under US$99 million (£76.5m) and the number of wagers decreased by 5.4 million year-on-year (y-o-y), player spend-per-bet went up by an average of US$10 to US$46.5 (£35), and total handle actually grew to US$1.42 billion (£1.08bn).

Per-Bet Levy

Effective from July 1, 2025, Illinois began charging online sportsbooks a per-wager tax of US$0.25 (£0.19) on the first 20 million bets, increasing to US$0.50 (£0.38) thereafter.

Rather than absorb the levy, licensed operators took one of two routes: Passing it on to players via a direct charge or introducing a minimum bet threshold.

Market leaders FanDuel and DraftKings both implemented a US$0.50 (£0.38) charge per bet. Caesars and Fanatics opted for a US$0.25 (£0.19) fee.

Meanwhile, BetMGM, Hard Rock and Circa chose to absorb the tax, but curb micro-betting by imposing minimum requirements of US$2.50 (£1.90), US$2 (£1.52), and US$10 (£7.60), respectively.

September marked the first full month when all Illinois sportsbooks enforced the new rules.

At the time of implementation, the familiar uproar followed: Warnings that increased taxes would force operators to offer less competitive odds and bonuses, ultimately pushing cost-sensitive players toward offshore sites where no fees or minimums apply.

At this stage, perhaps it’s too early to determine if the tax increase has indeed sent players scurrying to spend their hard-earned bucks at unregulated offshore casinos.

But the fact that the regulated handle increased suggests not.

Here’s what we are certain of:

The levy is altering player behaviour in ways that haven’t been seen in other jurisdictions that have hiked taxes and this raises important Responsible Gambling (RG) concerns.

Larger Wagers, Fewer Bets

Combined online and retail sports betting revenue for September reached US$100.7 million (£76.5m), down 26.2 percent from the US$137.1 million (£104m) generated in September 2024.

Of this total, online operators produced almost US$99 million (£75 million), representing a 15.2 percent y-o-y decline. The per-wager tax applies solely to online bets.

A year-on-year comparison reveals the shift:

The data suggests that the new taxation is causing players to place fewer bets but to increase the stakes when they do.

While several operators nudged players toward larger stake sizes through minimum bet thresholds, most stayed with low limits of under US$2.50 (£1.90). Except Circa, which has a US$10 (£7.60) minimum, and DraftKings, which removes all bet surcharges on wagers over US$50 (£38).

According to RG expert Keith Whyte this is problematic as before the levy, casual bettors: “Often bet in very small amounts, sometimes as low as 25- or 50-cents per bet.”

Whyte believes the new tax is pushing players to make bets that “could be outside their comfort zone”, a concerning development for RG. And one, arguably, that lawmakers should have seen coming.

Filling The Coffers

While early indicators show a mixed picture, one thing is clear: The new per-wager tax is proving highly-lucrative for the state of Illinois.

Over the course of September, online sportsbooks forked over US$10 million (£7.6m) in additional fees generated by the new levy.

And the state’s two biggest operators, FanDuel and DraftKings, which each processed over 11 million bets, paid the lion’s share – over US$4 million (£3m) each.

What’s Next For Illinois Bookies and Bettors?

As the dust settles and players and operators adjust to the new reality, it remains to be seen whether the behavioural shift will evolve further and how sportsbooks will respond.

Importantly, regulators will now need to monitor whether higher average stakes introduce new affordability and RG concerns, as early indicators suggest.

Watch this space.