Autumn leaves may be falling but powered by the return of across-the-board sporting action revenues everywhere are up, marking the U.S. market’s 19th consecutive quarter of growth. Welcome to the latest Letter From America.

You Too Caesars?

Vegas heavy-hitter Caesars Entertainment has been fined US$7.8 million (£5.95m) by the Nevada Gaming Commission for breaching AML protocols through its involvement with illegal–and now banged-up–bookmaker Mathew Bowyer.

The five-count sanction comes after Bowyer wagered and lost “millions of dollars” with Caesars between 2017 and 2024, including more than US$3 million (£2.29m) in 2017.

Caesars is not the only Vegas casino embroiled in the Bowyer scandal.

Resorts World, for example, paid US$10.5 million (£8.02m) for similar money laundering infractions, and MGM Resorts International accepted a US$8.5 million (£6.49m) fine in April.

Gaming Commission Chair Mike Dreitzer confirmed that the fine is three times the sum Caesars reportedly won from Bowyer over the seven years, while Caesars CEO Tom Reeg conceded: “The Bowyer affair has been a stain on the state. We’re embarrassed that we’re a part of it.

“We didn’t catch Bowyer, and we should have.”

Kiss-Kiss, Boom-Boom

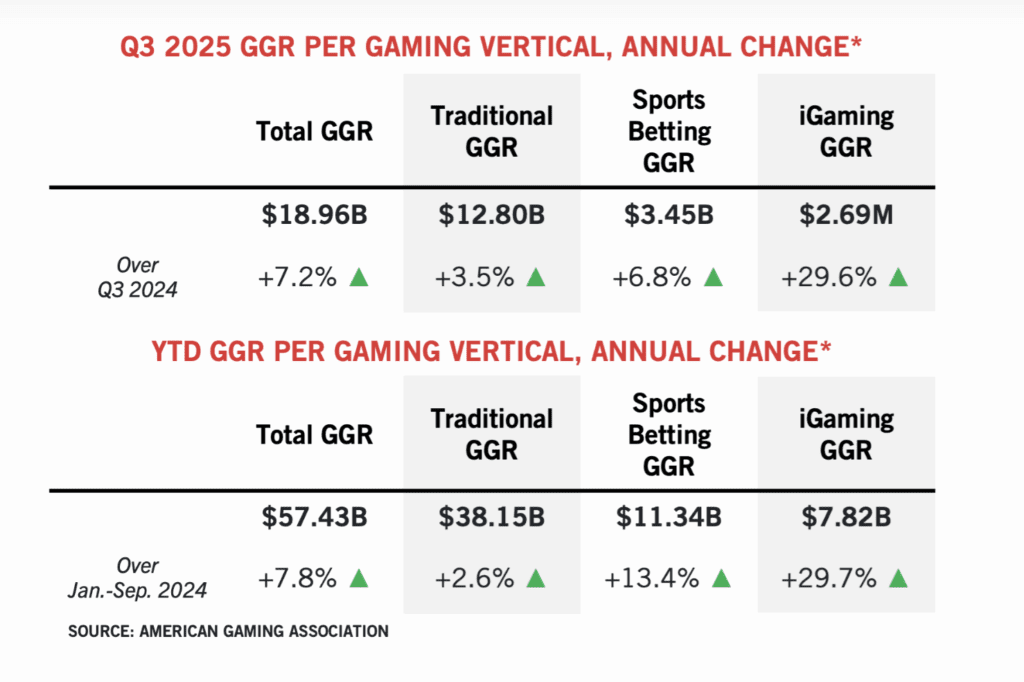

Despite Prediction Market headwinds, the American Gaming Association (AGA) has reported another record-breaking quarter for U.S. gambling.

Combined revenue from commercially-operated land-based casinos, sports betting and iGaming increased by 7.2 percent year-over-year (y-o-y), reaching US$18.96 billion (£14.47bn) in the quarter ending September 30.

Q3 was the industry’s 19th consecutive quarter of y-o-y growth, and its highest-grossing Q3 performance on record. Some 90 percent of states posted growth.

And with the NFL, College Football, the NHL and NBA all now well underway the boom continued into October.

New Jersey:

New Jersey:

Total NJ gambling revenue in October was US$611.1 million (£466.5m), up 22.3 percent. iGaming delivered US$260.3 million (£198.8m), up 21.8 per cent, setting a new record for the Garden State, with FanDuel leading the market.

Online sports bettors showed up in force, generating US$110.7 million (£84.5m) of the state’s US$116.1 million (£88.6m) total – up 49.8 percent y-o-y. FanDuel again took the lead.

Pennsylvania:

iGaming hit a record US$250 million (£190.8m) last month, beating March’s previous high of US$238 million. Total revenue reached US$597 million (£455.5m) in October, up 20.22 percent y-o-y. iGaming alone grew 35.5 percent.

New York:

The Empire State’s online sportsbooks generated GGR of US$238.7 million in October (£181.92m), the third highest monthly gross gaming revenue since the market opened in January 2022.

Flutter’s FanDuel became the first operator ever to pass a handle of US$1 billion (£763m) in bets.

Michigan:

Michigan’s iGaming receipts hit US$278.5 million (£212.6m), up 31.8 percent. Sports betting net revenue reached US$73.8 million (£56.4m). Operators paid more than US$15 million (£11.4m) in local taxes.

Massachusetts:

Lastly, MA sportsbooks generated a handle of US$892.2 million (£681.7m). Taxable income was US$73.5 million (£56.1m) for October – up 47.6 percent y-o-y. MA now ranks fourth nationally in monthly betting volume.

Fanatics Bails

Fanatics has followed FanDuel and DraftKings down the prediction market path, stepping outside state regulatory frameworks and seemingly hedging its future on innovation over compliance.

CEO Michael Rubin told CNBC the launch of Fanatics’ prediction-market platform, created in collaboration with CFTC-regulated Crypto.com, is only weeks away.

The product will operate in the 26 states where Fanatics holds no licences, targeting large and unregulated virgin markets, like California and Texas.

But most regulators have warned that operating or partnering with a prediction market in any state could lead to the loss of an operator’s gaming licence.

The battle lines are drawn.

Maryland Joins Anti-PM Movement

Speaking of regulators issuing warnings. Maryland has become the seventh state regulator to caution licence holders–following Massachusetts, Arizona, Illinois, Michigan, Nevada and Ohio–that involvement in prediction markets means licence re-evaluation.

The regulatory position–as in those six states–is that prediction markets offer unregulated sports betting, which is categorically illegal.

Winning Pitch

As December approaches, so does the deadline for New York’s long-awaited downstate casino licenses.

Three bids remain in the running: A major expansion of Resorts World New York City in Queens, Steve Cohen and Hard Rock’s proposed Metropolitan Park development beside Citi Field, and Bally’s planned US$4 billion (£3.05bn) resort at the former Trump Golf Links in the Bronx.

The latter comes with a notable twist: If Bally’s secures a casino license, the Trump Organisation stands to benefit from a US$115 million (£87.7m) special payment – pre-agreed in the lease contract.